-

ABK Group

- Profile

- Vision, Mission, and Core Values

- Key Milestones

- Corporate Governance

- Chairman of the Board of Directors

- Board of Directors

- Board Committees

- Executive Management

- Group Governance Framework

- Group Governance Structure

- Corporate Governance Manual

- Memorandum & Articles of Association

- Chairman's Message

- Annual Reports

- Financials

- Investor Presentations

- Investor/Analyst Conference Calls/Transcripts

- Credit Ratings

- Disclosures

- Awards

- Highlights

- Sustainability Reports

- Corporate Social Responsibility

-

Retail

- Alfouz Draw Account

- Salary Accounts

- Savings Accounts

- Term Deposits

- Discounts and Promotions

- Elite Banking

- Al Tajer

- Oil Sector

- Credit Cards

- Prepaid Cards

- Digital Payment Solutions

- Dispute Form

- Cards Payment Portal

- Travel Tips

- ABK Concierge

- Loans Types

- Basic Loan Rights

- Apply for a Loan

- Ask Sanad

- Safe Deposit Lockers

- Credit Information Network Company

- IBAN Validator

- Merchant Services

- Credit Card Limit Increase

- ABK Build

- Online Banking

- Mobile Banking

- Ahlan Ahli Telebanking Services

- Cash Issuing Terminals

- Cardlesss Cash Withdrawal

- Digital Branch

-

Wholesale

-

Treasury & Investment

- ABK Wealth Management

- News

-

Help & Support

- Anti-Money Laundering and Combatting the Financing of Terrorism

- Corporate

- FATCA & CRS

- IBOR

- Privacy Policy

- Cookies Policy

- Vendor Relations

- Fees & Commissions

- Let's Be Aware

- Customer Protection

- CBK Complaint Submission

- Customer Feedback Form

- Guidelines on Cash Withdrawal and Cash Deposit Complaints

- Online Banking Video Guide

- FAQ

- Kuwait Electronic Cheque Clearing System (KECCS)

- Contact & Find Us

- Careers

- Log in

- Open new account

Happy National & Liberation Day!

Credit Card Limit Increase Service

Need more spending power?

Our credit card limit increase service allows eligible customers to quickly and securely raise their credit card limit through the ABK mobile app, without the need to visit a branch.

Best Digital Transformation Initiative

Your Banking Partner for Business Success

Enjoy more benefits with Al Tajer and Al Tajer Plus

Pay in the Local Currency of the Country You’re Visiting

Always request to pay in the local currency of the country you are visiting to avoid any additional fees.

Cashback Made Unlimited With Even More Tokens!

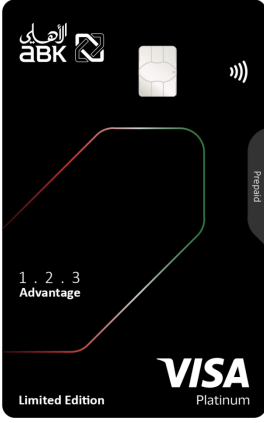

Introducing the ABK Visa Platinum Advantage 1.2.3 prepaid card.

Best Investor Relationship Bank - International Finance

ABK Wins 5 International Business Magazine Awards

ABK Wins 6 Global Finance Awards

A Card That Takes You Places

Introducing the new ABK Visa Infinite Advantage credit card.

Send, receive, and request

money effortlessly using a mobile number with 'WAMD'

Online Banking

CORPORATE

Providing a Seamless Experience to Our Corporate Customers

RETAIL

Delivering Exceptional Products and Services to Our Retail Customers

News

ABK Bowling Team Achieves Exceptional Success at the Banks Bowling Championship 2025–2026 Read More

Al Ahli Bank of Kuwait Group Holds EOY 2025 Analyst Conference Call Read More

ABK Sponsors Annual Porsche Club Kuwait Festival Read More

Al Ahli Bank of Kuwait Group Announces EOY 2025 Financial Results: 19.42% Increase in Net Profit to KD 62.59 Million Read More

Al Ahli Bank of Kuwait Sponsors Sports Day Event at Al Shaab Park Read More

ABK Supports Customers on Their Home-Building Journey with Exclusive and Exceptional Discounts from ABYAT Read More

ABK Launches Limited-Edition Kuwait Flag-Themed ABK Visa Platinum Advantage 1.2.3 Prepaid Card to Celebrate National and Liberation Days Read More

ABK Launches ABK Build with Strategic Partnership with Al Rashoud & Al Ramadhan Read More

ABK Demonstrates Extensive Support for ‘Let’s Be Aware’ Campaign Read More

ABK Sponsors Arab Elite Tennis Championship in Bahrain Read More

We care about your experience on our website, which is why Al Ahli Bank of Kuwait uses cookies. They help us remember you and how you use this website, which improves the browsing experience. They are stored locally on your computer or mobile device. These are described in more detail in our Privacy Notice and Cookies Notice. Further use of this site will be considered as consent.

×

Get the new ABK app for free

Kuwait

Kuwait

Egypt

Egypt